Page 24 - Boca ViewPointe - February '25

P. 24

Page 24, Viewpointe February 2025

Boca West Country Club Sponsors Its 15th Habitat

For Humanity Home And Participates In Its Home

Assembly Day

Board members and the president of Boca West The home, located at 460121 N.W. 10th Ave., South Now, Ramsey will be able to lay down the roots and

Country Club recently participated in Home Assembly Bay, is the 15th local Habitat for Humanity home build a strong foundation in the very place she was born

Day, where home modules were placed on a new Habitat sponsored by Boca West Country Club over the last 13 and raised; and with the stability and affordability that a

for Humanity lot. The home is being built for the deserving years, helping to provide affordable homes earned by a Habitat home brings.

Ramsey family, led by Ke’yanna Ramsey, who was born hard-working family. “We were so inspired by Ke’yanna and her family and

and raised in South Bay. Students from Seminole Ridge Ke’yanna Ramsey decided to apply for the homeownership were honored to help this deserving family achieve their

High School’s Weitz Construction Academy attached the program to build a better life for herself and her two children. dream of home ownership in partnership with Habitat for

roof to the home on Dec. 6. Boca West Country Club is As she worked through the program requirements putting Humanity,” said Matthew Linderman, CCM, president,

a major sponsor of the home. in the sweat equity, learning about budgeting and home COO and general manager of Boca West Country Club.

maintenance, at times she felt undeserving of this opportunity “Investing in our local community is important to the

and that the day when she became a homeowner would never members and team at Boca West and we have established

come. But everything changed when she received a call that

the lot in South Bay had become available. Boca West Country Club on page 25

Asset Protection in Estate Planning

You’re beginning to accumulate substantial wealth, but you worry about protecting it from future potential creditors. Whether your concern

is for your personal assets or your business, various tools exist to keep your property safe from tax collectors, accident victims, health-care

providers, credit card issuers, business creditors, and creditors of others.

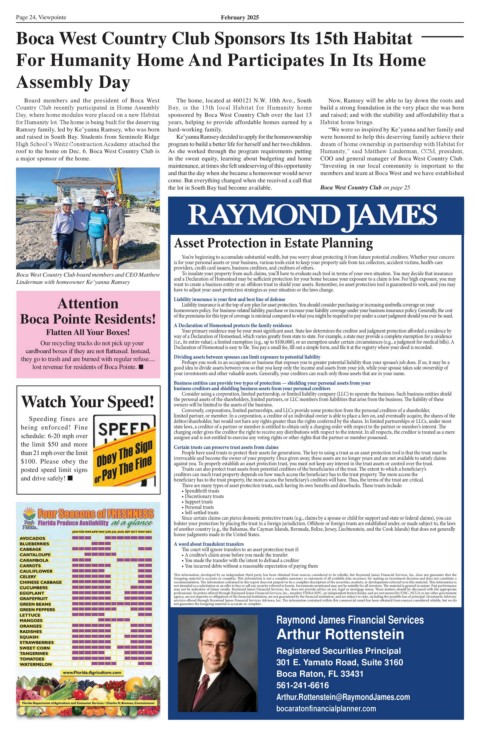

Boca West Country Club board members and CEO Matthew To insulate your property from such claims, you’ll have to evaluate each tool in terms of your own situation. You may decide that insurance

Linderman with homeowner Ke’yanna Ramsey and a Declaration of Homestead may be sufficient protection for your home because your exposure to a claim is low. For high exposure, you may

want to create a business entity or an offshore trust to shield your assets. Remember, no asset protection tool is guaranteed to work, and you may

have to adjust your asset protection strategies as your situation or the laws change.

Attention Liability insurance is your first and best line of defense

Liability insurance is at the top of any plan for asset protection. You should consider purchasing or increasing umbrella coverage on your

Boca Pointe Residents! homeowners policy. For business-related liability, purchase or increase your liability coverage under your business insurance policy. Generally, the cost

of the premiums for this type of coverage is minimal compared to what you might be required to pay under a court judgment should you ever be sued.

Flatten All Your Boxes! A Declaration of Homestead protects the family residence

Your primary residence may be your most significant asset. State law determines the creditor and judgment protection afforded a residence by

way of a Declaration of Homestead, which varies greatly from state to state. For example, a state may provide a complete exemption for a residence

Our recycling trucks do not pick up your (i.e., its entire value), a limited exemption (e.g., up to $100,000), or an exemption under certain circumstances (e.g., a judgment for medical bills). A

Declaration of Homestead is easy to file. You pay a small fee, fill out a simple form, and file it at the registry where your deed is recorded.

cardboard boxes if they are not flattened. Instead,

they go to trash and are burned with regular refuse.... Dividing assets between spouses can limit exposure to potential liability

Perhaps you work in an occupation or business that exposes you to greater potential liability than your spouse’s job does. If so, it may be a

lost revenue for residents of Boca Pointe. good idea to divide assets between you so that you keep only the income and assets from your job, while your spouse takes sole ownership of

your investments and other valuable assets. Generally, your creditors can reach only those assets that are in your name.

Business entities can provide two types of protection — shielding your personal assets from your

business creditors and shielding business assets from your personal creditors

Watch Your Speed! the personal assets of the shareholders, limited partners, or LLC members from liabilities that arise from the business. The liability of these

Consider using a corporation, limited partnership, or limited liability company (LLC) to operate the business. Such business entities shield

owners will be limited to the assets of the business.

Conversely, corporations, limited partnerships, and LLCs provide some protection from the personal creditors of a shareholder,

Speeding fines are limited partner, or member. In a corporation, a creditor of an individual owner is able to place a lien on, and eventually acquire, the shares of the

debtor/shareholder, but would not have any rights greater than the rights conferred by the shares. In limited partnerships or LLCs, under most

being enforced! Fine state laws, a creditor of a partner or member is entitled to obtain only a charging order with respect to the partner or member’s interest. The

charging order gives the creditor the right to receive any distributions with respect to the interest. In all respects, the creditor is treated as a mere

schedule: 6-20 mph over assignee and is not entitled to exercise any voting rights or other rights that the partner or member possessed.

the limit $50 and more Certain trusts can preserve trust assets from claims

than 21 mph over the limit People have used trusts to protect their assets for generations. The key to using a trust as an asset protection tool is that the trust must be

$100. Please obey the irrevocable and become the owner of your property. Once given away, these assets are no longer yours and are not available to satisfy claims

against you. To properly establish an asset protection trust, you must not keep any interest in the trust assets or control over the trust.

Trusts can also protect trust assets from potential creditors of the beneficiaries of the trust. The extent to which a beneficiary’s

posted speed limit signs creditors can reach trust property depends on how much access the beneficiary has to the trust property. The more access the

and drive safely! beneficiary has to the trust property, the more access the beneficiary’s creditors will have. Thus, the terms of the trust are critical.

There are many types of asset protection trusts, each having its own benefits and drawbacks. These trusts include:

• Spendthrift trusts

• Discretionary trusts

• Support trusts

• Personal trusts

• Self-settled trusts

Since certain claims can pierce domestic protective trusts (e.g., claims by a spouse or child for support and state or federal claims), you can

bolster your protection by placing the trust in a foreign jurisdiction. Offshore or foreign trusts are established under, or made subject to, the laws

of another country (e.g., the Bahamas, the Cayman Islands, Bermuda, Belize, Jersey, Liechtenstein, and the Cook Islands) that does not generally

honor judgments made in the United States.

A word about fraudulent transfers

The court will ignore transfers to an asset protection trust if:

• A creditor’s claim arose before you made the transfer

• You made the transfer with the intent to defraud a creditor

• You incurred debts without a reasonable expectation of paying them

This information, developed by an independent third party, has been obtained from sources considered to be reliable, but Raymond James Financial Services, Inc. does not guarantee that the

foregoing material is accurate or complete. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a

recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is

not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. The material is general in nature. Past performance

may not be indicative of future results. Raymond James Financial Services, Inc. does not provide advice on tax, legal or mortgage issues. These matters should be discussed with the appropriate

professional. Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC, an independent broker/dealer, and are not insured by FDIC, NCUA or any other government

agency, are not deposits or obligations of the financial institution, are not guaranteed by the financial institution, and are subject to risks, including the possible loss of principal. Investment Advisory

services offered through Raymond James Financial Services Advisors, Inc. The information contained within this commercial email has been obtained from sources considered reliable, but we do

not guarantee the foregoing material is accurate or complete.

Raymond James Financial Services

Arthur Rottenstein

Registered Securities Principal

301 E. Yamato Road, Suite 3160

Boca Raton, FL 33431

561-241-6616

Arthur.Rottenstein@RaymondJames.com

bocaratonfinancialplanner.com