Page 11 - Jupiter Spotlight - January '24

P. 11

Jupiter Spotlight, Page 11

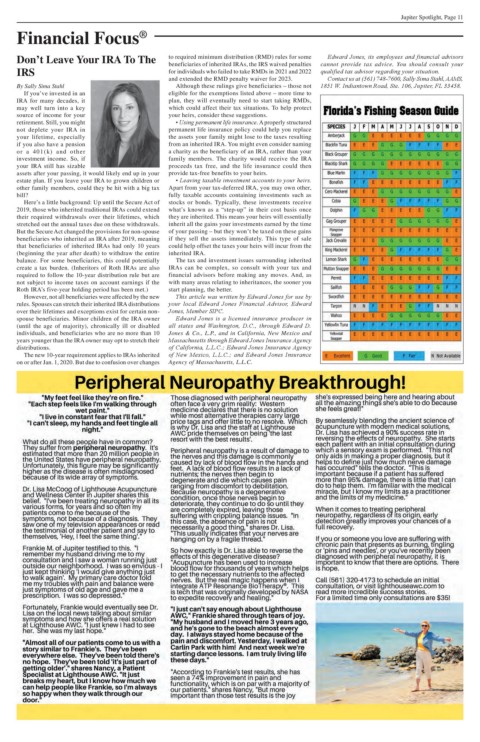

Financial Focus ®

Don’t Leave Your IRA To The to required minimum distribution (RMD) rules for some Edward Jones, its employees and financial advisors

beneficiaries of inherited IRAs, the IRS waived penalties

cannot provide tax advice. You should consult your

IRS for individuals who failed to take RMDs in 2021 and 2022 qualified tax advisor regarding your situation.

and extended the RMD penalty waiver for 2023. Contact us at (561) 748-7600, Sally Sima Stahl, AAMS,

By Sally Sima Stahl Although these rulings give beneficiaries – those not 1851 W. Indiantown Road, Ste. 106, Jupiter, FL 33458.

If you’ve invested in an eligible for the exemptions listed above – more time to

IRA for many decades, it plan, they will eventually need to start taking RMDs,

may well turn into a key which could affect their tax situations. To help protect

source of income for your your heirs, consider these suggestions.

retirement. Still, you might • Using permanent life insurance. A properly structured

not deplete your IRA in permanent life insurance policy could help you replace

your lifetime, especially the assets your family might lose to the taxes resulting

if you also have a pension from an inherited IRA. You might even consider naming

or a 401(k) and other a charity as the beneficiary of an IRA, rather than your

investment income. So, if family members. The charity would receive the IRA

your IRA still has sizable proceeds tax free, and the life insurance could then

assets after your passing, it would likely end up in your provide tax-free benefits to your heirs.

estate plan. If you leave your IRA to grown children or • Leaving taxable investment accounts to your heirs.

other family members, could they be hit with a big tax Apart from your tax-deferred IRA, you may own other,

bill? fully taxable accounts containing investments such as

Here’s a little background: Up until the Secure Act of stocks or bonds. Typically, these investments receive

2019, those who inherited traditional IRAs could extend what’s known as a “step-up” in their cost basis once

their required withdrawals over their lifetimes, which they are inherited. This means your heirs will essentially

stretched out the annual taxes due on these withdrawals. inherit all the gains your investments earned by the time

But the Secure Act changed the provisions for non-spouse of your passing – but they won’t be taxed on these gains

beneficiaries who inherited an IRA after 2019, meaning if they sell the assets immediately. This type of sale

that beneficiaries of inherited IRAs had only 10 years could help offset the taxes your heirs will incur from the

(beginning the year after death) to withdraw the entire inherited IRA.

balance. For some beneficiaries, this could potentially The tax and investment issues surrounding inherited

create a tax burden. (Inheritors of Roth IRAs are also IRAs can be complex, so consult with your tax and

required to follow the 10-year distribution rule but are financial advisors before making any moves. And, as

not subject to income taxes on account earnings if the with many areas relating to inheritances, the sooner you

Roth IRA’s five-year holding period has been met.) start planning, the better.

However, not all beneficiaries were affected by the new This article was written by Edward Jones for use by

rules. Spouses can stretch their inherited IRA distributions your local Edward Jones Financial Advisor, Edward

over their lifetimes and exceptions exist for certain non- Jones, Member SIPC.

spouse beneficiaries. Minor children of the IRA owner Edward Jones is a licensed insurance producer in

(until the age of majority), chronically ill or disabled all states and Washington, D.C., through Edward D.

individuals, and beneficiaries who are no more than 10 Jones & Co., L.P., and in California, New Mexico and

years younger than the IRA owner may opt to stretch their Massachusetts through Edward Jones Insurance Agency

distributions. of California, L.L.C.; Edward Jones Insurance Agency

The new 10-year requirement applies to IRAs inherited of New Mexico, L.L.C.; and Edward Jones Insurance

on or after Jan. 1, 2020. But due to confusion over changes Agency of Massachusetts, L.L.C.