Page 17 - Lifestyles in Palm Beach Gardens - August '24

P. 17

Lifestyles in Palm Beach Gardens, Page 17

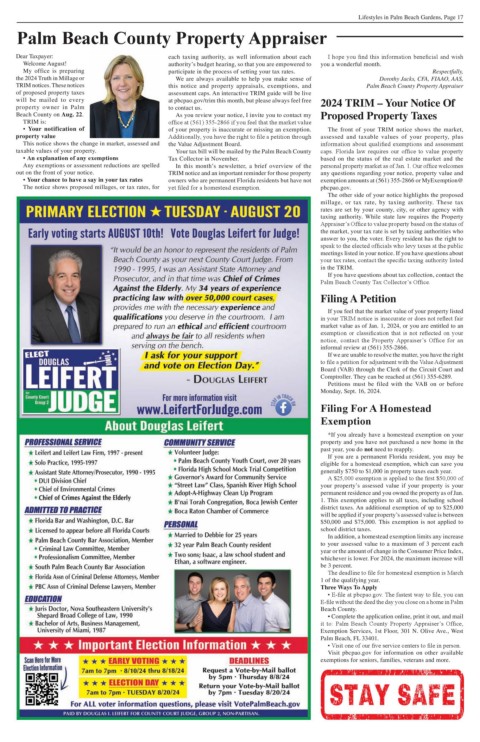

Palm Beach County Property Appraiser

Dear Taxpayer: each taxing authority, as well information about each I hope you find this information beneficial and wish

Welcome August! authority’s budget hearing, so that you are empowered to you a wonderful month.

My office is preparing participate in the process of setting your tax rates. Respectfully,

the 2024 Truth in Millage or We are always available to help you make sense of Dorothy Jacks, CFA, FIAAO, AAS,

TRIM notices. These notices this notice and property appraisals, exemptions, and Palm Beach County Property Appraiser

of proposed property taxes assessment caps. An interactive TRIM guide will be live

will be mailed to every at pbcpao.gov/trim this month, but please always feel free 2024 TRIM – Your Notice Of

property owner in Palm to contact us.

Beach County on Aug. 22. As you review your notice, I invite you to contact my Proposed Property Taxes

TRIM is: office at (561) 355-2866 if you feel that the market value

• Your notification of of your property is inaccurate or missing an exemption. The front of your TRIM notice shows the market,

property value Additionally, you have the right to file a petition through assessed and taxable values of your property, plus

This notice shows the change in market, assessed and the Value Adjustment Board. information about qualified exemptions and assessment

taxable values of your property. Your tax bill will be mailed by the Palm Beach County caps. Florida law requires our office to value property

• An explanation of any exemptions Tax Collector in November. based on the status of the real estate market and the

Any exemptions or assessment reductions are spelled In this month’s newsletter, a brief overview of the personal property market as of Jan. 1. Our office welcomes

out on the front of your notice. TRIM notice and an important reminder for those property any questions regarding your notice, property value and

• Your chance to have a say in your tax rates owners who are permanent Florida residents but have not exemption amounts at (561) 355-2866 or MyExemption@

The notice shows proposed millages, or tax rates, for yet filed for a homestead exemption. pbcpao.gov.

The other side of your notice highlights the proposed

millage, or tax rate, by taxing authority. These tax

rates are set by your county, city, or other agency with

taxing authority. While state law requires the Property

Appraiser’s Office to value property based on the status of

the market, your tax rate is set by taxing authorities who

answer to you, the voter. Every resident has the right to

speak to the elected officials who levy taxes at the public

meetings listed in your notice. If you have questions about

your tax rates, contact the specific taxing authority listed

in the TRIM.

If you have questions about tax collection, contact the

Palm Beach County Tax Collector’s Office.

Filing A Petition

If you feel that the market value of your property listed

in your TRIM notice is inaccurate or does not reflect fair

market value as of Jan. 1, 2024, or you are entitled to an

exemption or classification that is not reflected on your

notice, contact the Property Appraiser’s Office for an

informal review at (561) 355-2866.

If we are unable to resolve the matter, you have the right

to file a petition for adjustment with the Value Adjustment

Board (VAB) through the Clerk of the Circuit Court and

Comptroller. They can be reached at (561) 355-6289.

Petitions must be filed with the VAB on or before

Monday, Sept. 16, 2024.

Filing For A Homestead

Exemption

*If you already have a homestead exemption on your

property and you have not purchased a new home in the

past year, you do not need to reapply.

If you are a permanent Florida resident, you may be

eligible for a homestead exemption, which can save you

generally $750 to $1,000 in property taxes each year.

A $25,000 exemption is applied to the first $50,000 of

your property’s assessed value if your property is your

permanent residence and you owned the property as of Jan.

1. This exemption applies to all taxes, including school

district taxes. An additional exemption of up to $25,000

will be applied if your property’s assessed value is between

$50,000 and $75,000. This exemption is not applied to

school district taxes.

In addition, a homestead exemption limits any increase

to your assessed value to a maximum of 3 percent each

year or the amount of change in the Consumer Price Index,

whichever is lower. For 2024, the maximum increase will

be 3 percent.

The deadline to file for homestead exemption is March

1 of the qualifying year.

Three Ways To Apply

• E-file at pbcpao.gov. The fastest way to file, you can

E-file without the deed the day you close on a home in Palm

Beach County.

• Complete the application online, print it out, and mail

it to: Palm Beach County Property Appraiser’s Office,

Exemption Services, 1st Floor, 301 N. Olive Ave., West

Palm Beach, FL 33401.

• Visit one of our five service centers to file in person.

Visit pbcpao.gov for information on other available

exemptions for seniors, families, veterans and more.